How I’d grow Ramen Express

Who doesn’t love ramen? What a great product. It hits all the right spots: nostalgic, affordable, and tasty.

At first glance, Ramen Express looks like another attempt at refreshing an old product — repackaging for Millennials. We’ve seen this before. Warby Parker started it. Away was at the end of that era.

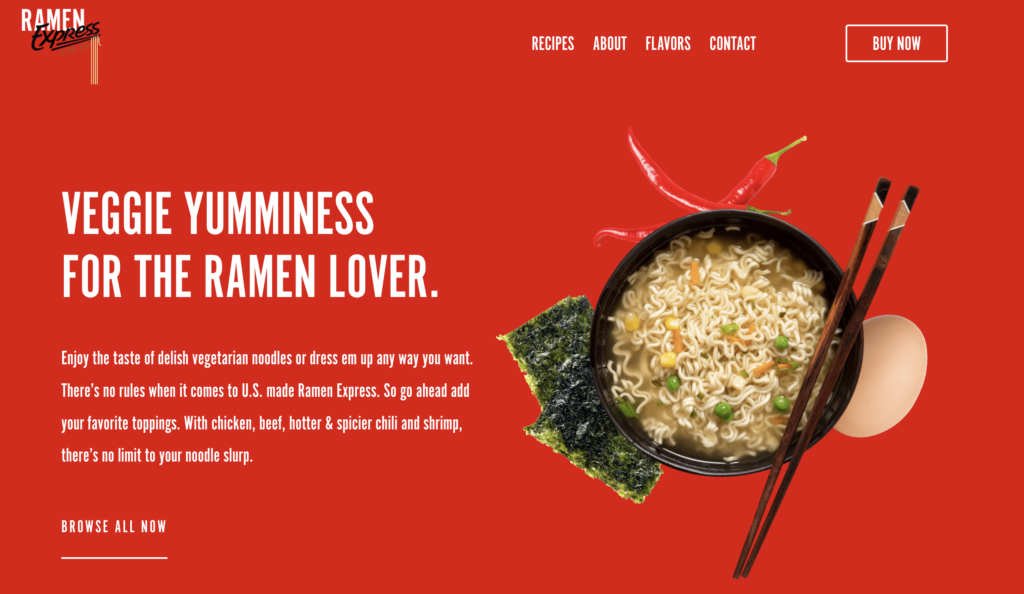

Vegetarian noodles with real flavors. My read: We’re everything you love about ramen, except healthier. Added bonus, there’s no dairy or MSG (not that there are issues with either, but for those who care). And, they are Kosher and Halal.

First, we want to understand their customer based on their positioning. Here’s are some things we can consider:

- Other ramen noodle brands

- Packaging style

- Price point

- Sales strategy

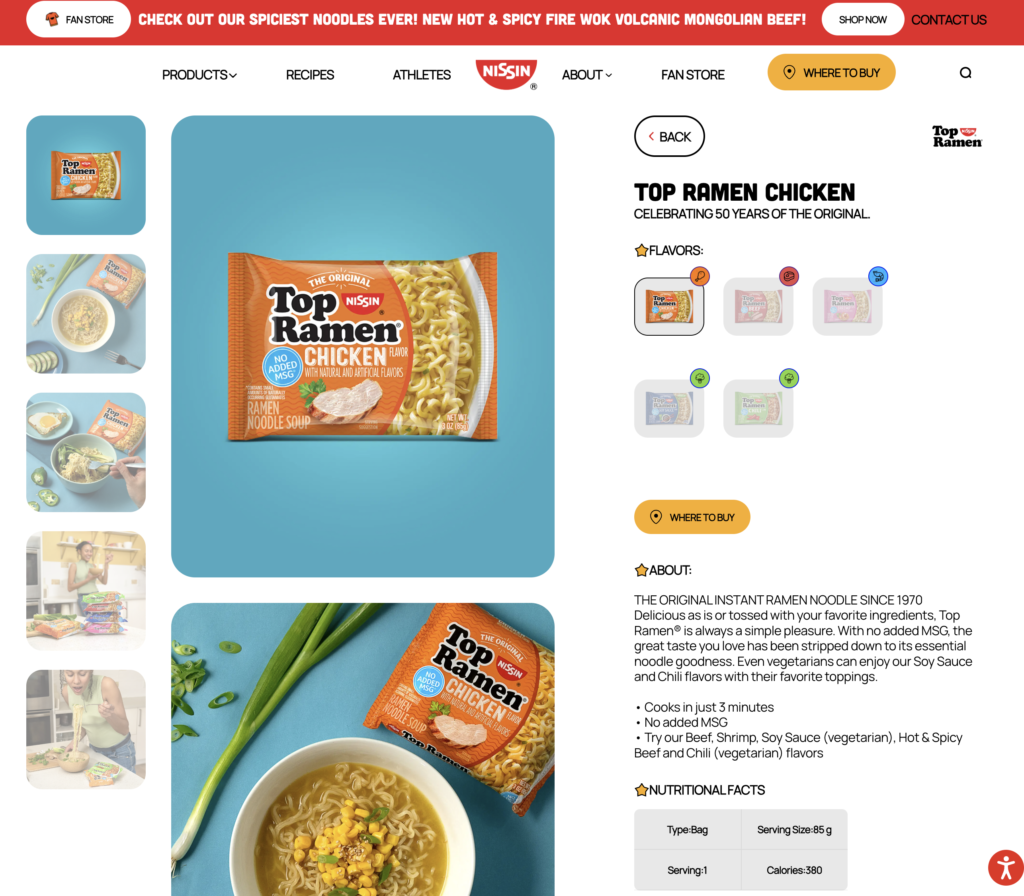

Even though many brands make instant noodles, they aren’t all widely distributed. Seems like their biggest competitors are Nissin, makers of Top Ramen and Cup Noodles, and Momofuku.

Everything about Ramen Express screams cup noodles. It’s not unless you search around their website that you see they offer pillow packs too.

They use Amazon for e-commerce. At $16-$18 for 12 cups, they are priced closely with Top Ramen in the grocery store ($0.99/pack). But, you can grab Cup Noodles from Instacart (and plenty of other vendors) for close to $0.50-$0.75. This makes Ramen Express a deluxe or luxury staple. Even though they aren’t trying to go up against Momofuku, they may be fighting a battle for attention with the same customer. Tricky.

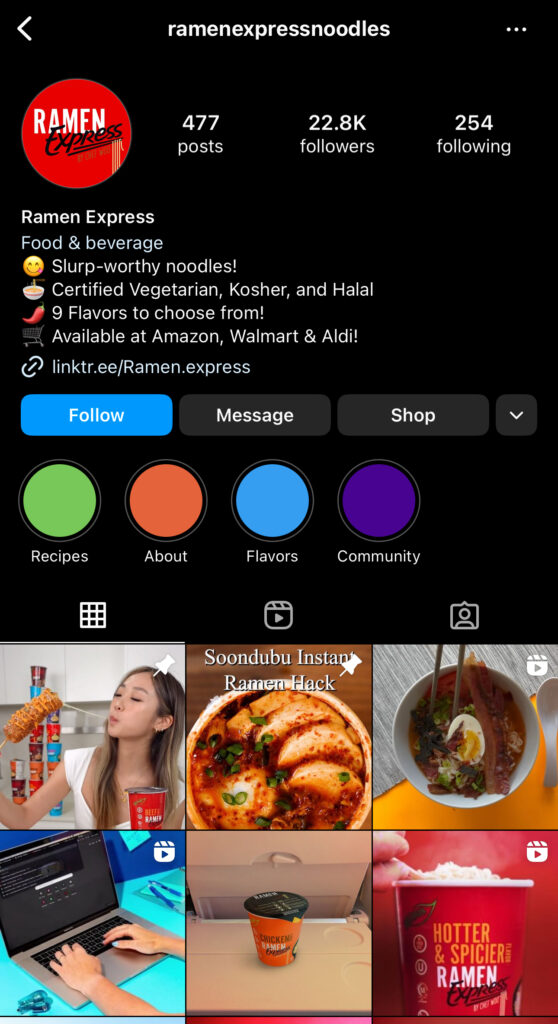

This healthy ramen can be found on Amazon, Walmart, and some other online retailers. It’s not clear to me that you can find them on many local grocery store shelves. With one exception, their Instagram tells me they’ve landed at HEB which is cool! (Oh, and I guess, Aldi)

To figure out where to grow, let’s look at the challenges.

- Selling through Amazon has a lot of limitations. Their biggest competitor, Nissin, does this too. But, they are established players with accounts at almost every major grocery store in the US. Momofuku has an online store on top of their omnichannel strategy. This gives them more insight into their customers and better opportunities for nurturing and re-marketing. Plus, first party data!

- The brand is confusing. There is Ramen Express by Chef Woo, and Chef Woo. Both brands make the same thing with different flavors. It’s like brands created by consultants to target two separate audiences. Seems like their owner, Palmetto Foods, has dreams of cornering the ramen market.

- We’re in the era of holistic brand building, but Ramen Express feels creatively stagnate. Their social media isn’t consistent. The use of influencers and creators seems flat. It’s like they’re running the brand marketing playbook from 2018.

- The website is nice but not with the times. The first image of a real human is a guy chomping cup noodles with a virtual reality headset on. Lame. The use of color is great but the brand lacks a soul. Nissin’s website is crushing it.

Here’s what I’d do to start making waves…

Branding

Simplify. We don’t need two branded products for two different target markets. A better approach: pick who your core market. Is it former ramen lovers hoping for a healthier version? Or, is it ramen fanatics that want to make it at home? Is it a fast food option for young, busy professionals trying to climb the career and income ladder?

Once they pick a direction, they can speak to us more effectively. If they want us to switch, they’ll need to give us a reason.

Social Media

Most customers are have adapted to brands and how they sell to us. They can sniff out influencers and UGC creators selling us product. I’d get creative. What about people we don’t expect to eat ramen showing up on our feed slurping it down? I would still tap food and beverage creators, but I’d target health and wellness folks too. Nissin has gone after athletes. How can Ramen Express show up and surprise us? Give us the unexpected. Everybody from yoga influencers to college kids whipping up cheap hangover recipes in their dorms.

Omnichannel

The packaging is pretty good. They need to sit next to other ramen brands so they can be compared up close and personal. I’m willing to bet most people buy their ramen at the grocery store. It’s key to discovery and lowers the friction for a trial. Show people you taste as good or better as the original brands, while keeping the price low. I’d give it a shot.

Growth Ideas

This is where it gets fun. When you have a product that’s this cheap, you can do a lot of testing! Here are some experiments I’d run if I was their growth marketer:

- Free Taste Test: I’d set a budget and offer to mail anyone who signs up for our newsletter a free sample of their flavor choice. Product and shipping probably costs around $2/pack. For $5k, I could get the product in the hands of 2,500 prospects. I can follow this up with re-marketing through email. Not to mention, now I know their taste preferences! It would be great if we had our own online shop.

- Health and Wellness Partnerships: Is it possible to change the negative association ramen has with our health? Best way to test this would be with brands and creators that have authority in the health space. Can they generate sales and engagement?

- Host a Ramen Cooking Show: Put together a series of videos showcasing everybody from master chefs to home cooks preparing their favorite ramen recipes. Get a fun and engaging host that can add some comedy to the mix. It can run long form on Youtube for episodes with special guests. All of it can get chopped up for Instagram and Tiktok. Like Bon Appetit’s Test Kitchen meets HealthyJnkFood.

- Pop-Ups on the Cheap: Borrowing this idea from Feisty via Ashwinn. Feisty took a few hundred dollars and popped up with their dogs outside of a Whole Foods. Make it happen on a budget. It’s going to pay off!

- Go Niche: Create some content that speaks to a niche where you can win some unique and popular search terms. Like health and ramen. When people search is ramen healthy, you get our blog content explaining its nutritional value, easy recipes, and more. Is ramen bad for you gets 6600 searches per month!

Ramen is a delicious space with a few large players and low differentiation. To win, you need to be loved and sell volume. It’s a hard task that requires creativity and scrappiness. And, like Ramen Express, we can look at our brands and create a plan of attack. Use this break down to help think about your approach to brand and growth marketing.

Website red flags you should avoid

Marketing creators are fun to watch. Their website reviews and advertising hot takes are informative. I’m deep in the marketing game too. I see everything in the world like a ticker tape of selling. It’s hard not to have my own opinion.

I recently compared two brands. I highlighted the difference between good and bad copy.

🚩Too much text

🚩Too much ego (i.e. lots of “We” statements)

🚩Too much insider talk (i.e. jargon and complex words)

These red flags are noise. And, noise pushes customers away from your brand and into the arms of another lover. The two brands I looked at were Beehiiv and Ghost. Today, we’ll look at new examples. When we’re done, I want you to be able to spot messaging that grabs customers.

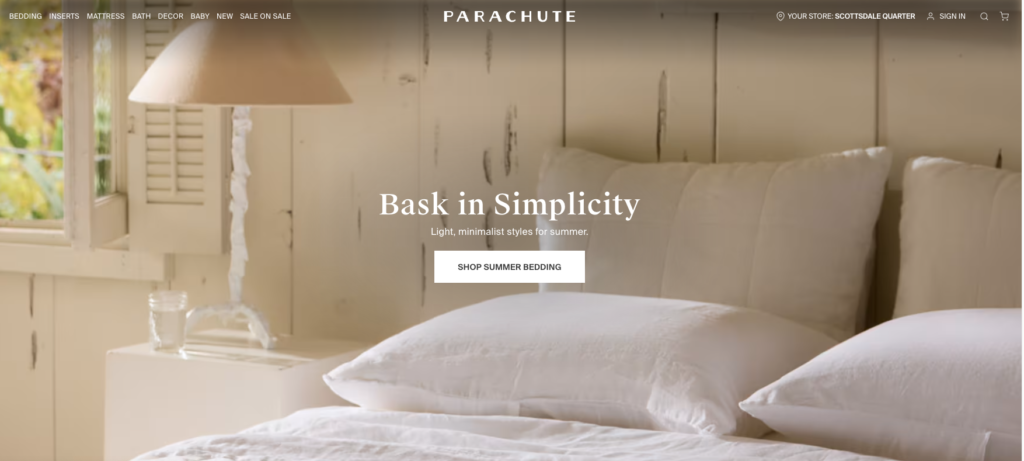

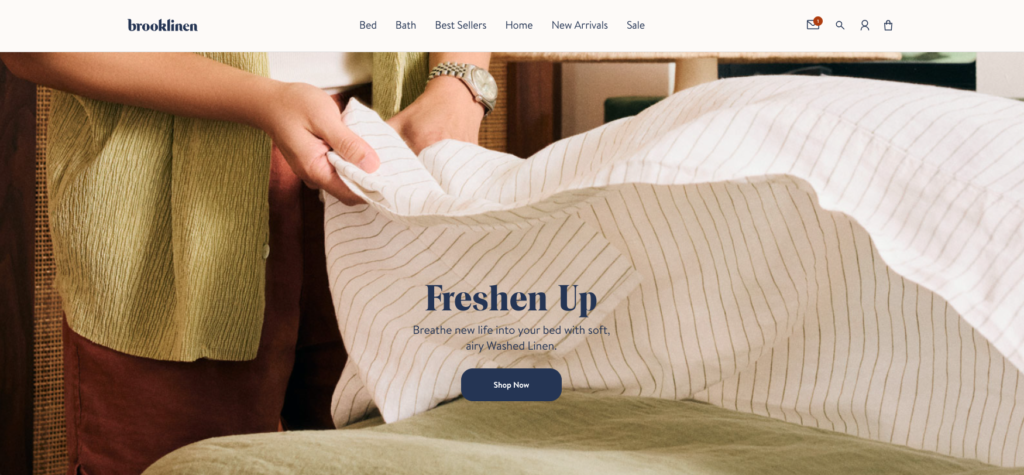

Parachute vs. Brooklinen

Both brands take a different approach to imagery. Which copy approach do you favor? Brooklinen shines because they show a successful outcome. I can smell fresh laundry and imagine soft sheets against my skin.

Parachute is simply selling me new product. 🚩No story, no engagement.

Take a look at each brand’s about page. There’s a big difference. Can you spot it?

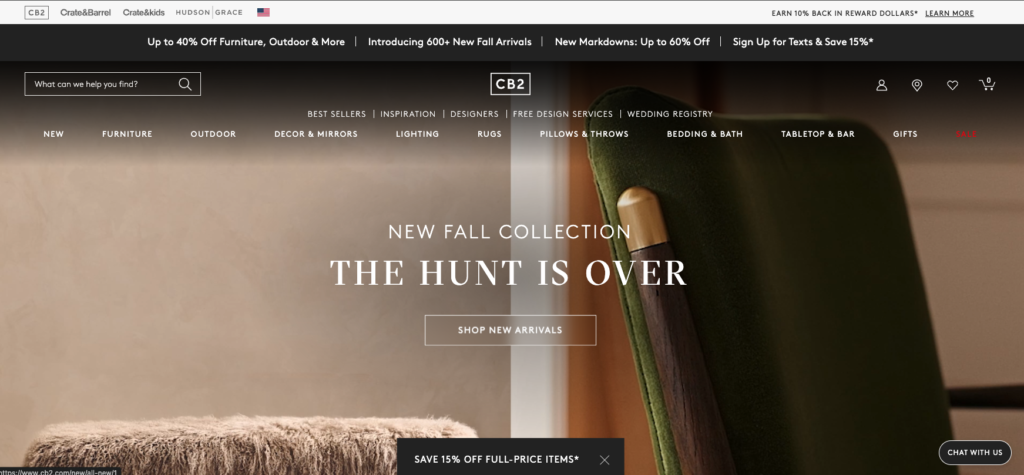

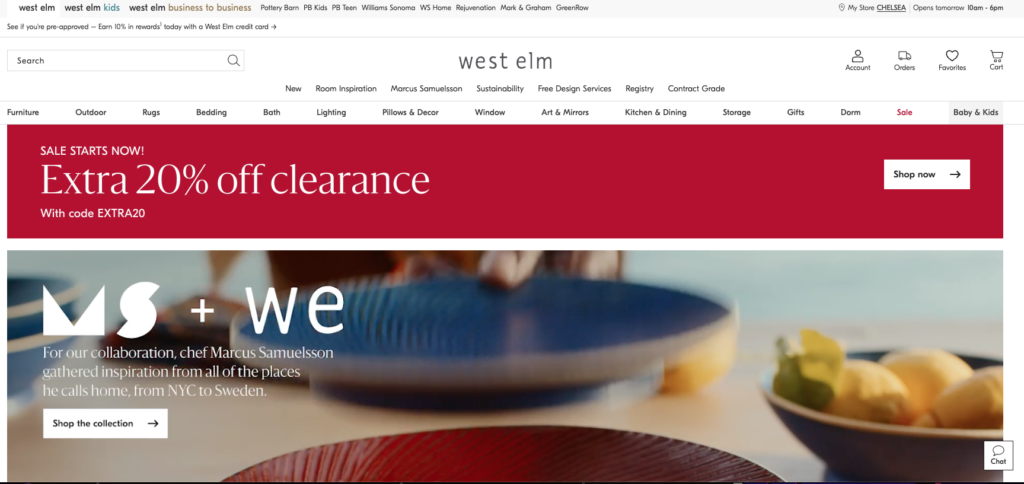

CB2 vs. West Elm

Big e-commerce shops often get formulaic. I don’t think either does a great job helping me feel connected. Yet, CB2 does a masterful job at using visuals to overcome. Their headline copy gives me the sense their curation will blow me away. I don’t need to look any further.

Meanwhile, West Elm is a sh*t show. Below the fold, they do a much better job. It’s a bummer. Let’s ignore the numerous ways to navigate the site. Their collaboration with Marcus Samuelsson is beautiful. But, it makes their partnership the hero—not the customer. You can tell they negotiated every inch of this partnership.

Also, why drop a significant collaboration under the banner of a clearance sign? I’m utterly confused. 🚩Too much mental energy required.

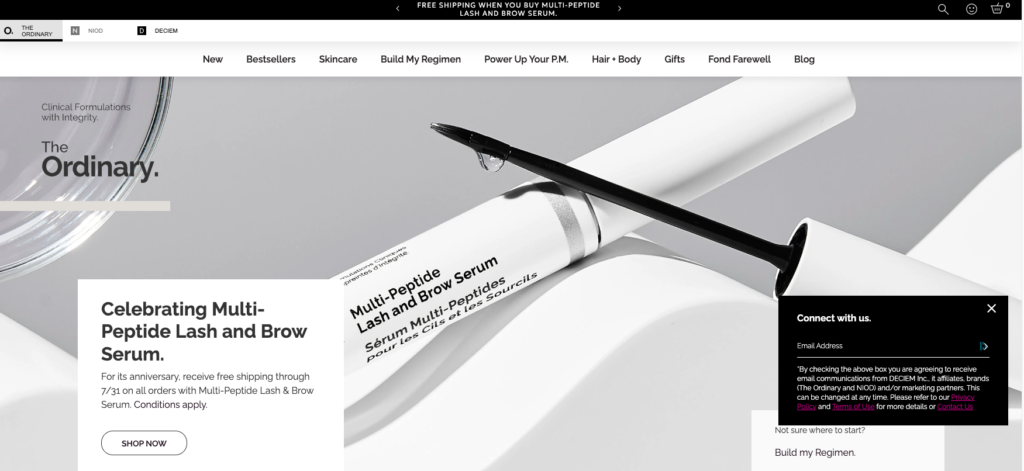

The Ordinary

This is the most sterile homepage I’ve seen today. The Ordinary has a chance to show off how their products help their customers revitalize their skin. Instead, the headline makes their product the hero. Companies should try to sell solutions to customer problems. There’s not one reason I need to click “Shop Now.”

“Clinical Formulations with Integrity.” What does that even mean? Who is this copy for, the competition? First impression: The Ordinary has no soul. 🚩Too much insider talk.

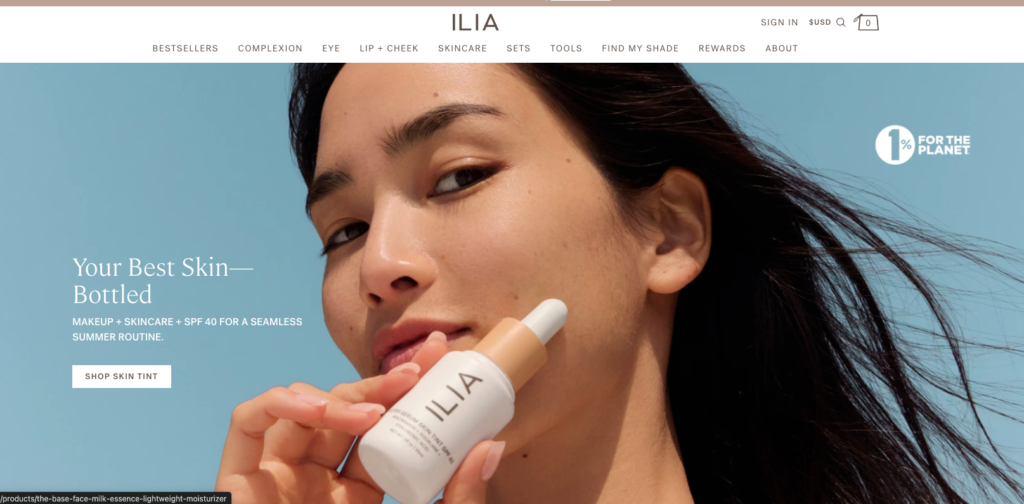

Ilia

I can see it. The solution to my skin problem is one click away. The model’s skin is amazing but not flawless. This could be me! Bonus: A CTA (call-to-action) that let’s me know I can find product to match my skin tone. The 1% for the planet logo is extra goodwill; a cherry on top.

Key Takeaways

If you want to sell more stuff, you need to engage your customer. I love Donald Miller’s marketing grunt test. Potential customers need answers to 3 questions to engage with our brands. They need that information within five seconds of seeing our website or marketing materials:

- What do you offer?

- How will it make my life better?

- What do I need to do to buy it?

This is only part of the story. But, you’d be surprised how often this isn’t clear. Do you know Sey Coffee? I love their coffee. Their website, confusing. If I had more time, I might order a bag off their site instead of driving to Brooklyn from Harlem. The website is frustrating. I’ll pass for now.

Review these examples. Consider how you present to your customers. Be simple and clear. Cut out the noise.

Multiple streams of income is a myth

Do you know what it takes to spin up multiple streams of income? How many people do you think actually get wealthy from it?

The answer…probably far fewer than you’d think.

There’s a giant issue with trying to create multiple streams of income. Your focus gets split. There aren’t many people that are excellent at their side hustles. No shade. IMHO, it’s not the path you should obsess over.

Outside of working for big corporate, building a business is the only feasible path to wealth. Risk taking isn’t for everyone. If you’re comfortable with betting on yourself, you’re in the right place.

I want you ignore all the fast money advice you see. Ignore the tax strategies from the “wealthy” guy being interviewed outside of his country club in a Ferrari. Ignore the investing schemes. Ignore the Instagram ads trying to sell you a course on writing conversion-driving copy.

Instead, make one decision. How are you going to add value to the world? Hint: There’s only two ways.

- Innovate. Invent a product that solves a big problem.

- Improve. Take an existing solution and make it better.

Crazy, right? It’s that simple.

I love startups because they force intense focus. You have to be an expert at the problem you’re solving. You have to be an expert on the customer you’re solving the problem for. It’s like getting a master’s or PhD. You get deep knowledge.

Rest assured. When you have created value by solving a big problem for your customers. You will be rewarded. After that, you can diversify. Let your money work for you by investing in other asset classes. This is where multiple streams of income makes sense.

Besides, do you know why people are asked to do TED Talks or speak at big conferences? Because they’re f*cking great at a specific thing. Being undeniable unlocks doors and opportunity.

Today’s advice: If you’re doing too much; STOP. Focus on the activity you believe will bring you the most return on your investment and energy. Cut the rest. If you’re looking for motivation, read 10x Is Easier Than 2x. That’s it. You’re on your way.

Underrepresented startup founders unite

The lead investor for my last startup, Slauson & Co., hosted a virtual event called “Framing the Pitch.” Slauson is an early stage venture capital firm rooted in inclusion that believes your lived experience is your competitive advantage. They’ve done a lot of work trying to expand access to capital for underrepresented founders. As founders, the deck is stacked against us. You’re not alone. Competition, limited capital, rising CAC costs, finding and hiring talented teammates… the list is long.

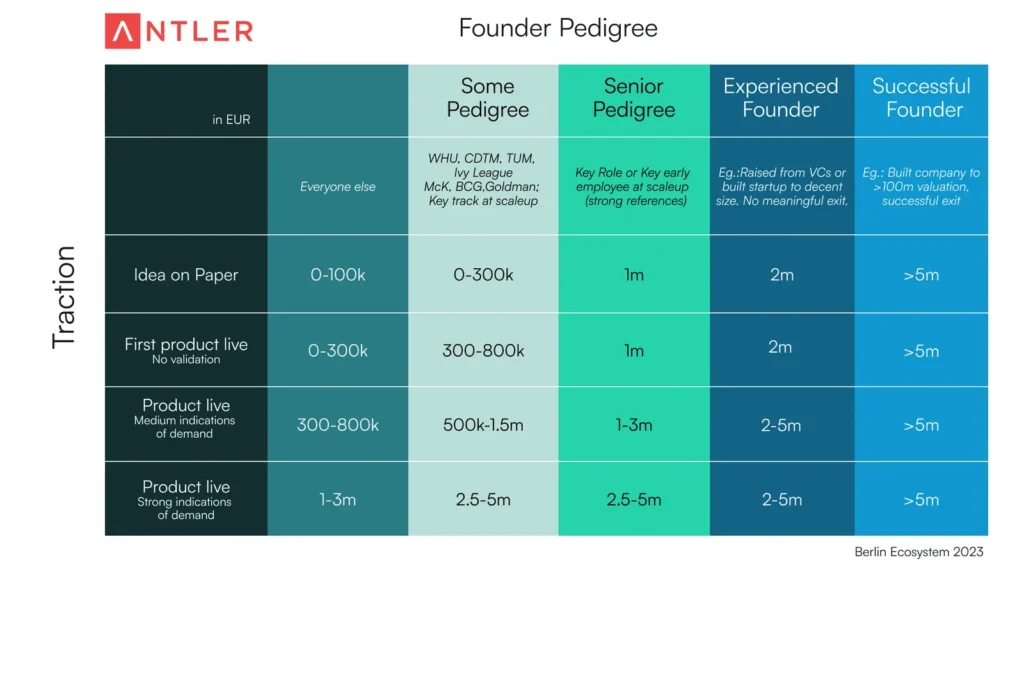

Pre-seed is about traction. But, it’s equally about whether investors believe you and your team are the right folks for the job. During the presentation, Slauson shared this graphic from an article posted by a VC firm named Antler. It highlights potential raise amounts when considering the founder’s pedigree and the product traction achieved. (in EUR, not USD)

I’m writing to you on Juneteenth. I’m less than 3 months away from a potential fundraise. It’s hard not to reflect on how this world is built. Specifically, the pathways for success are built for people that look and behave a certain way. Staring at this chart, I see myself. I’m ex-Goldman. I’ve been a founder already. I successfully raised venture capital too. But, what doesn’t this chart say?

VC investments in Black-owned startups reached nearly $5 billion in the U.S. in 2021. In 2022, it was cut in half to $2.4 billion. Last year, Crunchbase found that only $705 million in venture funding went to Black-owned startups. I can’t see the productivity in postulating all the reasons capital doesn’t get deployed to Black entrepreneurs. I can say that is crushing on the psyche.

It means most of the advice across the internet and social media might be useful but it wasn’t made for founders like me. Because, the system wasn’t built for people like me. They simply allow us to participate. Our parents weren’t lying to us when they said, “You need to work 2-3x harder than the other kids in school if you want to make a life for yourself.”

Your ideas can be great. Your validation and traction may be impressive. You will walk into a pitch. And, an investor will still judge your success probability based on your race or gender. Bias is real, even if it is subconscious. Justin, what am I supposed to do with this harsh reality?

Make yourself undeniable. Take advantage of resources created by people that look like you and care about you, whenever possible. Your gut is important, but be a f*cking expert. Be an expert on your industry, your product, your customer and their problems. I’m currently reading scientific research papers and having daily conversations to mine data and up my game. Be so fluid you can teach a class. Then, learn how to synthesize your expertise in a digestible way through compelling storytelling. Above all else, engage with the community so we can support one another. Nobody should have to do this alone.

I’m starting a company, day 5

I’m feeling energized! A had another conversation with my co-founder. We were looking at an almost impossible fundraise. After our chat, we landed on a plan that makes raising money achievable. It’s early in our process. We have subscribed to the roller coaster of uncertainty and determination. Here’s a look at how our conversation helped us change our strategy.

Venture capital does not like retail

Last week, I looked at 5 important questions to consider before pitching to investors. A core question was about validation and PMF. At first, we wanted to start our business with an entry into retail (physical locations). We would need to raise a lot more money, increase our fixed costs with leases, and hire staff. At worst, investors could view this as a real estate play. It could be an instant turn-off.

VC funding in retail dried up in 2022. 2021 was a banner year, and then every thing changed. Venture funding hasn’t returned in size anywhere except AI since then. Investors are most interested in tech companies. Yet, they are more discerning than ever. Does the tech solve a big enough consumer problem? Is tech core to the business model or mentioned in the pitch deck 100 times? Venture investors are not looking to fumble the bag with interest rates being so high. They have alternative ways to generate comparable returns with less risky assets.

Venture capital loves high returns and mitigated risk

The CPG space has also fallen out of favor. This is the general segment we’re entering. Consumer brands were on fire but the excitement masked a lot of problems. For instance, many CPG businesses raised a lot of cheap money and focused on growth at all costs. The model worked ok when acquiring customers was also cheap. They gravy train can’t last forever. Money got expensive and so did customer acquisition. Those business models had unprofitable unit economics. We’re seeing many examples of these startups and their investors getting burned. See: All Birds.

It’s all more complex than my summary. But, it’s important to note where VC investors may be sensitive and have concerns. We can address them upfront. One way to mitigate risk is to shift strategy from physical retail to online. And although DTC and CPG is scary, we can show a solid go-to-market (GTM) strategy and a data driven process. The biggest question: How will we acquire customers for less?

Having a perspective in saturated markets

Companies succeed when they solve problems for customers. Finding the right problem to solve is the hardest job for an entrepreneur. We’ve identified the problem in our industry. There is too much choice. We are in a curation economy. People are looking for authentic authorities to help them with buying decisions. Our industry hasn’t caught up.

We are an attention economy. Nobody has time for anything. Attention spans are shorter than ever. There is more content than ever. We’ve made things easier and harder at the same time. Our industry has missed the boat on taste, media trends, and consumer shopping shifts. If you want to succeed in saturated markets, you must have a perspective.

Our perspective is that consumers want a curated selection of product. They want to be able to educate themselves on the product in less than 30 seconds. They don’t want to feel intimated. They want a brand experience that feels relatable and authentic. And, they want a sense of community. Lower friction and more trust.

Dreaming of lower CAC and higher LTV

We can’t approach investors with a lackluster margin story. They don’t want to hear that paid media is our solution to getting customers. Our initial brainstorm yielded some great ideas. Considering your go-to-market strategy? Here are some ways we are thinking about keeping acquisition costs down.

- Entertaining and educational content. Create short form content that allows customers to feel smart at the next dinner party. Integrating the content within the shopping experience will lower friction.

- Rockstar affiliates. Our industry is full of experts that have never gotten their shine. If we platform them, we can turn them into an authority and sales pipeline for us.

- Trend surfing. Provide expert curation on our primary offering. Then, expand the offering to include the more of the customer’s lifestyle needs and wants. Nobody in our industry is doing this.

- Gamification and loyalty: With curated offerings there are ways to motivate purchases. Consider ways to reward customers and add surprise and delight to the experience.

- Personalization on steroids: Our industry is all about taste. Taste is an area ripe for personalized recommendations and education.

Founders love options

Making this shift, from retail to online, allows us some leeway. It means we can raise less money. Raising less money is still hard but it opens up the types of investors we can approach. We can focus on friends and family, as well as angel investors. Having a pre-seed round allows us to explore our idea and gather data. This approach gives us a chance to build something and achieve validation and PMF. If all goes well, we’ll be in a better position to enter the seed stage. Bonus, we don’t have to incur a bunch of fix costs that will erode our margins and unit economics story. It’s a win-win.

I’m starting a company, day 4

There are two essential tasks in front of me. First, creating a compelling story. Second, drafting financial projections that are reasonable and align with the story. I’ve shared the business idea with a couple people. There is a lot of excitement. But, that’s not great validation. I have concerns about fundraising for this idea. So, I drafted some big questions for us to consider.

Things to consider before pitching VC funds

Below are some key questions we should try answering before pitching to investors. I’ll provide my thoughts along with each. I encourage you to bounce your ideas against a wall. And, with others. See what sticks. See where there are questions or constructive feedback. It’s early. There’s no need to have complete certainty at this stage.

Will investors invest on thorough research and pitch but no validation?

We’ve all heard the rumors or watched the movies. A founder pitches a napkin idea. They haven’t built anything. Yet, investor fill their bank account because of the big visions storytelling. It’s hard to find real life examples though. We are underrepresented start-up founders. Not because we don’t have pedigree, experience, and work ethic. But, because we’re Black and brown. We should consider ourselves the rule; not the exception.

Can we raise a Seed round without building something?

Hard truth: F*ck tech. I actually love technology, but that’s not our purpose. How long have you known about AI? Guess what. There are approximately 67,200 AI companies worldwide. About 25% of AI companies are in the US. Even if a company isn’t building AI software, they’re definitely exploring implementation. Technology is a crowded space. We will use tech to enhance the consumer experience and operational efficiency. We will be tech-enabled, but not a tech platform.

It’s harder than ever to raise money. Will investors have an appetite for a startup disrupting a retail vertical? We definitely have something going for us. We’re attacking a space that’s established but stale. We have an opportunity to sell the disruption story.

How can we build PMF or early validation?

Validation often comes before PMF. It’s the process of determining if your target market has interest in your products. We’re entering an established market. I’m not sure if validation is what we need. We need to prove the concept we’re introducing to the market and not the product itself. We’ll have to see what early investor feedback says. But, we’ll still need to cover our bases and get ahead.

PMF is short for product market fit. Your product is resonating with customers in a way that allows the business to grow. This feels more aligned with a challenge we need to solve right away. I split PMF into two camps: signals and facts. Buy-in is more powerful than signal. Here’s an example:

Types of Product Market Fit Signals

- # of people on a waitlist

- # of newsletter subscribers

- # of social media followers (across all channels)

- # of surveys validating an idea or product

Types of Product Market Fit Facts

- # of pre-sales or deposits

- #sales (i.e. for us, setup an online business before building physical retail)

- # of high quality commitments (i.e. potential customer takes reputation risk)

The difference is vast. It’s worth watching the video below. Also, read 12 Things About Product-Market Fit by Andressen Horowitz. A lot of the resources you’ll find online about startups are about tech startups. It’s the world we’re living in. There are useful nuggets, but keep that in mind.

How much capital do we need?

We have general estimates. For instance, we earmarked about $250k for each door we open. This would encapsulate build out, inventory, and staff. We also would need money to pay ourselves a livable NYC salary. Our first projection is a raise between $3M-$5M. This would put us in a Seed stage conversation. Yet, pre-revenue businesses tend to raise pre-seed money first. Pre-seed rounds are much smaller. In the past, pre-seed funding is likely under $1M.

First, we need financial projections to see if our back of envelope math is accurate. Then, we need to research funds and investors. Each will have their own method. It’s our job to find target investors that understand our market. We can’t seek out tech investors for an idea that doesn’t need tech to work. They will have unreasonable expectations. And, they likely aren’t interested at all. Raising this amount of money will require many things. If we can land a key lead investor, it will likely lower the friction to reaching our target number.

How will investors react to opportunity size? i.e. TAM, SAM, SOM

The acronyms TAM, SAM, and SOM speak to market size. TAM stands for total addressable market. I’ve linked a page that unpacks this with in-depth details. The best way to derive these numbers is through industry and market research. I’ve included a list of resources you can tap in my day 2 article. These numbers are important to understand if you want VC funding. You may not need VC cash to build your business. But, I’d still recommend understanding your market size and opportunity.

Luckily, entering an established market allows for rich data. We can show numbers on market, industry, and consumer trends. We’ll be able to illustrate how we plan to disrupt our industry and capture our target customers. Given we aren’t a tech startup, we don’t know how investors will react. The numbers will be big, but will that matter? Early feedback will be useful in our fundraising process.