There are two essential tasks in front of me. First, creating a compelling story. Second, drafting financial projections that are reasonable and align with the story. I’ve shared the business idea with a couple people. There is a lot of excitement. But, that’s not great validation. I have concerns about fundraising for this idea. So, I drafted some big questions for us to consider.

Things to consider before pitching VC funds

Below are some key questions we should try answering before pitching to investors. I’ll provide my thoughts along with each. I encourage you to bounce your ideas against a wall. And, with others. See what sticks. See where there are questions or constructive feedback. It’s early. There’s no need to have complete certainty at this stage.

Will investors invest on thorough research and pitch but no validation?

We’ve all heard the rumors or watched the movies. A founder pitches a napkin idea. They haven’t built anything. Yet, investor fill their bank account because of the big visions storytelling. It’s hard to find real life examples though. We are underrepresented start-up founders. Not because we don’t have pedigree, experience, and work ethic. But, because we’re Black and brown. We should consider ourselves the rule; not the exception.

Can we raise a Seed round without building something?

Hard truth: F*ck tech. I actually love technology, but that’s not our purpose. How long have you known about AI? Guess what. There are approximately 67,200 AI companies worldwide. About 25% of AI companies are in the US. Even if a company isn’t building AI software, they’re definitely exploring implementation. Technology is a crowded space. We will use tech to enhance the consumer experience and operational efficiency. We will be tech-enabled, but not a tech platform.

It’s harder than ever to raise money. Will investors have an appetite for a startup disrupting a retail vertical? We definitely have something going for us. We’re attacking a space that’s established but stale. We have an opportunity to sell the disruption story.

How can we build PMF or early validation?

Validation often comes before PMF. It’s the process of determining if your target market has interest in your products. We’re entering an established market. I’m not sure if validation is what we need. We need to prove the concept we’re introducing to the market and not the product itself. We’ll have to see what early investor feedback says. But, we’ll still need to cover our bases and get ahead.

PMF is short for product market fit. Your product is resonating with customers in a way that allows the business to grow. This feels more aligned with a challenge we need to solve right away. I split PMF into two camps: signals and facts. Buy-in is more powerful than signal. Here’s an example:

Types of Product Market Fit Signals

- # of people on a waitlist

- # of newsletter subscribers

- # of social media followers (across all channels)

- # of surveys validating an idea or product

Types of Product Market Fit Facts

- # of pre-sales or deposits

- #sales (i.e. for us, setup an online business before building physical retail)

- # of high quality commitments (i.e. potential customer takes reputation risk)

The difference is vast. It’s worth watching the video below. Also, read 12 Things About Product-Market Fit by Andressen Horowitz. A lot of the resources you’ll find online about startups are about tech startups. It’s the world we’re living in. There are useful nuggets, but keep that in mind.

How much capital do we need?

We have general estimates. For instance, we earmarked about $250k for each door we open. This would encapsulate build out, inventory, and staff. We also would need money to pay ourselves a livable NYC salary. Our first projection is a raise between $3M-$5M. This would put us in a Seed stage conversation. Yet, pre-revenue businesses tend to raise pre-seed money first. Pre-seed rounds are much smaller. In the past, pre-seed funding is likely under $1M.

First, we need financial projections to see if our back of envelope math is accurate. Then, we need to research funds and investors. Each will have their own method. It’s our job to find target investors that understand our market. We can’t seek out tech investors for an idea that doesn’t need tech to work. They will have unreasonable expectations. And, they likely aren’t interested at all. Raising this amount of money will require many things. If we can land a key lead investor, it will likely lower the friction to reaching our target number.

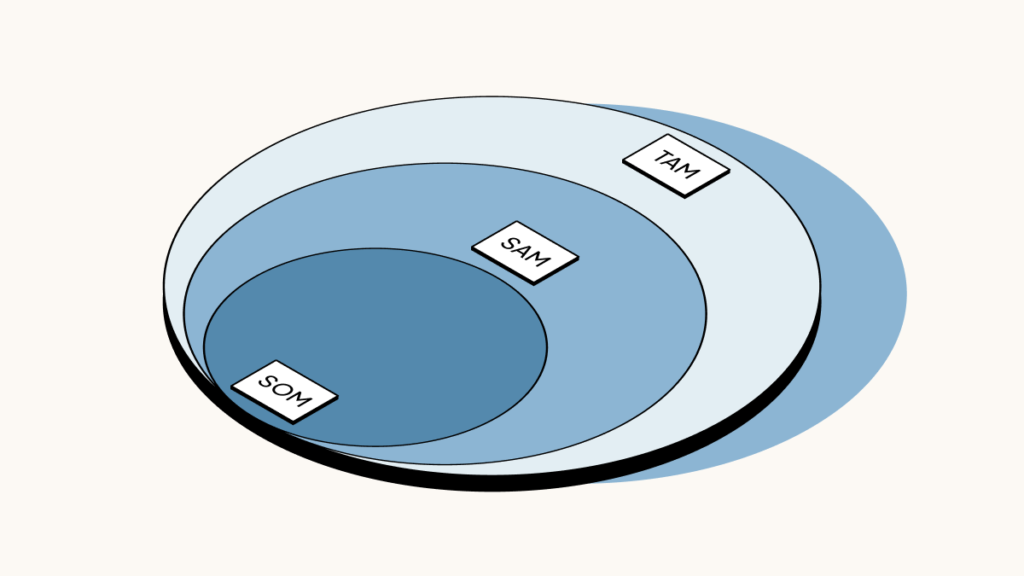

How will investors react to opportunity size? i.e. TAM, SAM, SOM

The acronyms TAM, SAM, and SOM speak to market size. TAM stands for total addressable market. I’ve linked a page that unpacks this with in-depth details. The best way to derive these numbers is through industry and market research. I’ve included a list of resources you can tap in my day 2 article. These numbers are important to understand if you want VC funding. You may not need VC cash to build your business. But, I’d still recommend understanding your market size and opportunity.

Luckily, entering an established market allows for rich data. We can show numbers on market, industry, and consumer trends. We’ll be able to illustrate how we plan to disrupt our industry and capture our target customers. Given we aren’t a tech startup, we don’t know how investors will react. The numbers will be big, but will that matter? Early feedback will be useful in our fundraising process.